Why Big Data Matters to Product Manufacturers, Both Large and Small

Gone are the days when you can “go with your gut.” Most major manufacturers are collecting and using Big Data in ways to improve product quality, streamline manufacturing performance, and optimize their product offerings. To compete in the 21st century, these businesses recognize they can’t just rely on gut intuition and feedback from sales to guide major investments. Instead, they must develop tools to track their products, competitors, customers, and brands. They must gather and analyze the data, then convert that business intelligence into actionable improvement and innovation.

Businesses have been using data for decades, but recent technological leaps have dramatically increased the amount and types of data they can collect and store. In a world of smartphones, smart products, and tiny, low-cost sensors, almost anything can be tracked and counted. Data sets have become so large, numerous, and complex that new techniques have to be created to manage and analyze it. And that’s where Big Data comes in. “Big Data” refers to these massive data sets and the specialized analytic techniques being developed to process it. Compared to traditional data analysis, Big Data promises to give you more data (it tracks everyone, not just a sample), faster (often, queries can be made real time), with more variety (it combines many types of data).

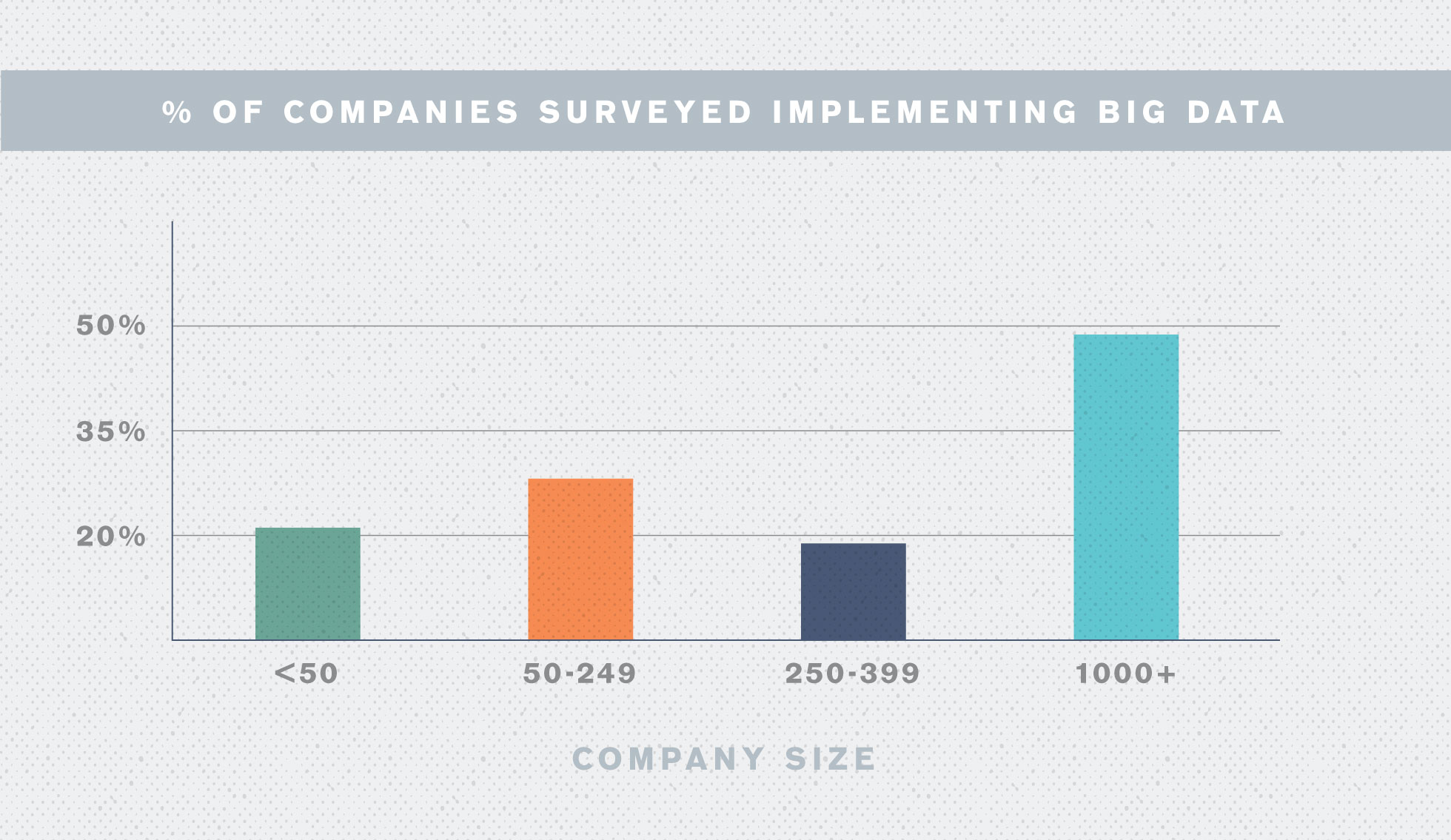

From global brands like Google and Apple to service titans like LiveNation and AirBnB, big business is drinking the big data Kool-Aid, and using it to stay ahead of smaller competitors (with their smaller databases). But ambitious startups and dynamic mid-sized manufacturers are getting smart, utilizing some surprisingly accessible data gathering techniques to build their own business intelligence, and outfox the giants.

Product manufacturers of every size are in a unique position today to gather and harness Big Data to improve their business. Working with their retail, manufacturing, and research partners, brands today should be using data to help answer these fundamental questions:

- Who are our customers / end users and what do they want?

- How can we make our product or service better?

- What gaps or opportunities exist in the market?

Whether your business is just dipping its toes into the big data waters or drowning in statistics, this paper will help you optimize your data gathering and analysis to get more useful and actionable results to fuel product innovation.

Use Data to Get to Know Your Customer

Every interaction with your customer, whether it’s through your product, website, sales, or service, can be a source of valuable data, if you know what to look for and which questions to ask. By learning about who your customers are and what makes them tick, you’ll do a better job of targeting your best, most profitable customers with products tailored to their needs and wants.

First, establish programs to continuously gather and analyze the data to which you have easy access, such as sales numbers and customer databases. Then work to discover the additional input needed to flesh things out. There are a variety of resources available today to learn more about the people who are buying your products, including web surfing habits, shopping history, hobbies, and more. And if the information isn’t available, it can be acquired with targeted research.

Combine this information with demographic data like age, sex, income, occupation, geography, etc., to build a set of customer personas. These are representative characters that embody the qualities and quirks of your various customer types. Use them to provide inspiration for each business segment as you seek to serve your customers better. And share with your creative teams to help innovate and validate new product concepts.